Photo by Alena Darmel

Closing costs are the fees and charges for all the services that have been performed through the homebuying process, such as home inspections and credit reports. These costs are paid to vendors during the closing or settlement of a home purchase.

Photo by RODNAE Productions

Closing Costs for History Houses in Central VA

Both the buyer and seller pay closing costs in Virginia, with each party paying for different services and fees. The agent commission fees and transfer taxes are paid by the seller, while the buyer pays for most of the other closing costs.

The median sale price in Virginia is $435,000, and buyer closing costs are about 1.55% to 2.06% of the final home sale price. Based on this estimate, you can expect to pay $6,740 to $8,961 in closing costs (after taxes).

To get a more exact closing costs Virginia estimate, it is essential that you meet with a mortgage advisor, so that you can ensure you have enough cash on hand. Your realtor will also play an important role in this, as they have access to the Multiple Listing Service (MLS) portal, which provides a calculator for approximating closing costs of specific properties.

Photo by Andy Henderson on Unsplash

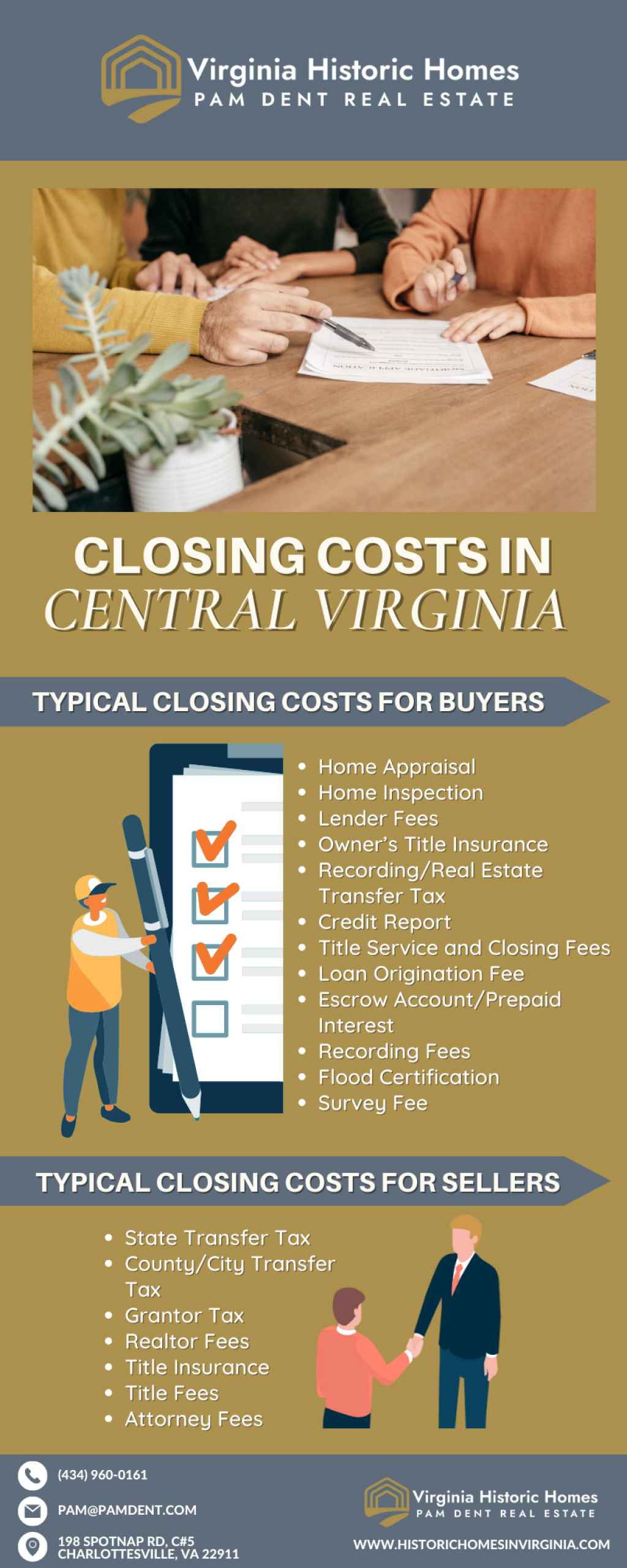

What Are the Typical Closing Costs for Buying/Selling a Historic House in Central VA?

Typical Closing Costs for Buyer in Virginia

| Item | Average Cost |

|---|---|

| Home Appraisal | $300 - $365 |

| Home Inspection | $300 - $450 |

| Lender Fees | $900 - $1,300 |

| Owner’s Title Insurance | $190 |

| Recording/Real Estate Transfer Tax | $0.25 per $100 of Property Value |

| Credit Report | $25 |

| Title Service and Closing Fees | 0.3% |

| Loan Origination Fee | 0.5% - 1% of Total Loan Amount |

| Escrow Account/Prepaid Interest | 0.7% |

| Recording Fees | $50 |

| Flood Certification | $20 |

| Survey Fee | $350 |

Typical Closing Costs for Seller in Virginia

| Item | Average Cost |

|---|---|

| State Transfer Tax | $50 for Every $500 of Property Value |

| County/City Transfer Tax | Varies |

| Grantor Tax | 0.1% or $1 for Every $1,000 |

| Realtor Fees | 3% to Each Agent, for a Total of 6% |

| Title Insurance | $3.70 per $1,000 for Homes $250,000 to $500,000; $3.40 for Homes $500,000 to $1,000,000 – etc. |

| Title Fees | $700 - $1100 |

| Attorney Fees | $500 |

Are There Any Tax Incentives for Buying a Historical House in Central VA?

There is the Historic Rehabilitation Tax Credit, which offers a 25% tax credit on eligible rehabilitation expenses through the Department of Historic Resources. In Virginia, a taxpayer can only claim up to $5 million in rehabilitation tax credits for any taxable year.

Virginia employs three tax credit reviewers, who examine the proposed project’s scope of work and specifications, including construction drawings to ensure the project meets the federal historic preservation standards. Reviews can take around 30 to 45 days.

Photo by Andy Henderson on Unsplash

How Do I Know If a Property Is Considered a "History House"?

In the United States, historic places and homes are determined and monitored by the National Park Service, and are listed on the National Register of Historic Places. A home can also be designated as historic by its state and municipality.

To be designated as a historic property, a home should be at least 50 years old (although there are some exceptions) and meet one of these four criteria:

- The home is connected to significant, historical events.

- The home is connected to the lives of significant individuals.

- The home is considered an embodiment of a particular master or historic style.

- The home has provided or is likely to provide important historical information.

Are There Other Benefits to Owning/Selling a Historic House in Central VA?

Historic houses in Central VA possess a charm that is unparalleled by modern homes. One of the benefits of buying a historic home is owning a property that comes with a very high value because it’s unique and hard to find in the current market.

Another advantage is having more space compared to what you would usually get from any other type of home, making it perfect for families or people who are looking for a property with bigger rooms and living space.

Conclusion

Now that you know what the average closing costs in VA are, you can make better financial decisions and prepare the budget for this particular obligation. If you’re currently looking for a historic home for your next residence, I’d love to show you your options.

Please give me a call today at (434) 960-0161 or email me at Pam@PamDent.com to schedule an appointment.

Frequently Asked Questions

How much is the closing cost in Central VA?

The median sale price in Virginia is $435,000, and buyer closing costs are about 1.55% to 2.06% of the final home sale price. Based on this estimate, you can expect to pay $6,740 to $8,961 in closing costs (after taxes).

Are tax breaks or other incentives available for purchasing a historic house in Central VA?

There is the Historic Rehabilitation Tax Credit, which offers a 25% tax credit on eligible rehabilitation expenses through the Department of Historic Resources. In Virginia, a taxpayer can only claim up to $5 million in rehabilitation tax credits for any taxable year.

What should home buyers be aware of when buying a historical house in Central VA?

It is important to read all applicable preservation regulations before purchasing the property. Once you have purchased your dream historic home, any work that will affect the exterior appearance of the home will require review or permits.

There’s a chance you’d encounter challenges in arranging financing and insurance. It could be more difficult to schedule an appraisal of the property and, sometimes, lenders shy away from historical homes altogether.

And because renovations on historic homes can be a bit costly, many insurance companies might be hesitant to offer homeowners policies. Fortunately, there are insurance companies that specialize in historic homes, but, as with everything else historic, this will cost more.

What are some of the most important things to consider when buying a historic house in Central VA?

It is important for every historic home buyer to learn and understand the unique costs of owning an old property and how this is different from a property with newer structures.

Can you recommend any attorneys or real estate agents specializing in historic houses in Central VA?

Look no further! As a proud owner of a historic home, I’m particularly familiar with the quirks and charms of the older properties in Central Virginia. My experience with historic properties makes me especially qualified to assist you with purchasing or selling one of these unique properties. Contact me today.